|

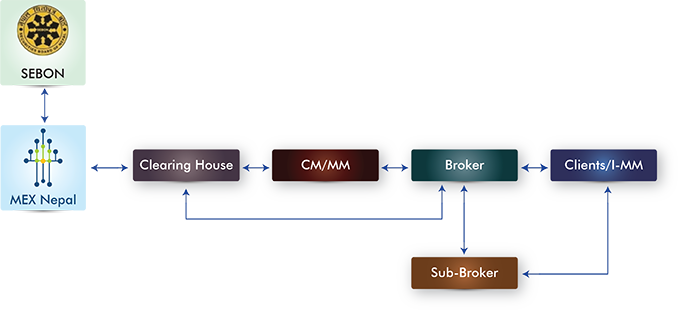

Market Structure

Regulatory Body (SEBON)

Securities Board of Nepal (SEBON) is the proposed regulatory body of the derivative commodity market in Nepal. SEBON will play the role of advisory to the Government of Nepal in respect to matters relating the commodity market in Nepal. SEBON will also overview the markets and take actions deemed necessary from time to time in exercise of the powers assigned to it by the act. To collect and whenever the regulatory body thinks it necessary, to publish information regarding the trading conditions including information regarding supply, demand and prices, and to submit to the Government, periodical reports on the working of the markets relating to such commodities.

Exchange (MEX Nepal)

A commodity exchange is bound by the rules and bye-laws and also by the law of land. The main role of an Exchange is to provide an efficient trading platform with global standards and binding principles and administrative services to its market participants and members. Exchange supervises, observes and has surveillance over the market activities and ensures the smooth and fair operation of trade. It appoints Clearing Members and Market Makers. The other role of an Exchange is to look after the concerned grievances unsolved at Clearing House & Clearing Member's level. Exchange have a very efficient dispute settlement system, with conciliation and arbitration in place for timely settlement of any trade related issues.

Clearing House (CH)

As a central counterparty, Clearing House acts as buyer to every seller and seller to every buyer to ensure the financial security of the marketplace and help clearing participants limit credit risk and achieve operational and financial efficiency. Clearing House shall ensure an array of active number of Market Makers and Clearing Members providing liquidity in the market. The principal activities are to provide trading access on electronic commodity exchanges to professional, individual and institutional traders and Brokers, as well as the clearing and settlement of their trades.

Clearing Member (CM)

Clearing Member (CM) is the registered institution with financial requirements as prescribed by the Exchange which does the clearing and settlement of all the trades of their respective clients along with other administrative works like providing margin leverage, customizing transactional fees, client registration, introducing brokers/sub-brokers, margin call updates, offline support etc. They earn mainly from the transactional fees from their clients and can charge customizable commissions to their clients based on the market competition and services they provide. They also act as a Market Maker while clearing the given trades which means they can enjoy multiple benefits than any other entity. They can appoint other Market Makers, Brokers, Sub-Brokers as well. However, Market Makers are required to have an agreement with the Exchange, fulfilling the prerequisites.

Institutional Market Maker [MM] & Individual Market Maker [I-MM]

Market Maker is any individual or institution, independent or appointed by CH, registered with the Exchange who quotes Bid and Ask prices for various contracts simultaneously by which the market depth is created and the best prices are generated to execute the orders initiated by the clients. They also trade for profit making but their orders get executed and matched when their intentions are available in the market depth as top priority with that of any client that takes market order or any other market makers close their open positions or clients’ limit/stop orders reach to the level of Best ASK/BID price. However they also can close their open position any time during the trading session.

Broker

Broker is an institution licensed by CH in accordance with criteria prescribed by the Exchange who have right to introduce Sub-Brokers and Clients. They act as a market facilitator to traders, providing advisory services, keeping their clients updated and informed about any concerns regarding trading opportunities, handling grievances, thereby, ultimately bridging clients with Clearing Member, Clearing House and Exchange.

Sub-Broker

Sub-broker is an individual or institution who has right to trade on behalf of clients or monitor client's trades. They also act as a bridge between Broker and Client.

Clients

Clients are the actual traders i.e. speculators, hedgers or arbitrageurs in the market, trading for risk mitigation arises from price volatility or profit-making from price volatility itself. They get registered under a broker, by filling the Client Registration forms and fulfilling the requirement of supporting docs and trade with the help of their broker/sub-broker.

Other Market Participants:

Delivery Vendor & Warehouse

The activities related to the delivery of goods in commodity market are done through Delivery Vendor & registered warehouse. Delivery vendor & registered warehouse places the selling intention and the buyer places the buying intention through the trading console of the MEX. The situation result the market running in price-time priority basis and there is matching of order. After the payment and settlement of the commodity, client can present the warehouse receipt to the delivery vendor & registered warehouse and can get delivery of commodity from the designated place of the delivery vendor & registered warehouse. After the delivery is confirmed, there is final settlement for delivery vendor & registered warehouse.

|