|

|

|

| Page Hits : 11152 |

|

|

Mercantile Exchange Blog |

|

|

| |

Nov 9 2012 |

| Commodity Channel Index (CCI) |

Commodity Channel Index (CCI) is an oscillator that is used in technical analysis to help govern when a specific commodity has been overbought and oversold. The CCI, developed by Donald Lambert, actually quantifies the relationship among the asset's price (Pt), a Simple Moving Average (SMA) of the asset's price, and normal deviations (D) from that average.

The CCI, along with other oscillators, can be a cherished tool to identify potential crests and troughs in the asset's price, and thus provide the stakeholders with rational substantiation to assess variations in the direction of price movement of the asset.

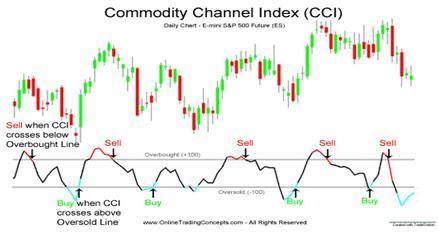

Fig: An example of how to use the CCI for buy and sell signals is given below in the chart of the E-mini S&P 500 Futures contract

The CCI is calculated as the difference between the typical price of a commodity and its simple moving average, divided by the mean absolute deviation of the typical price. The index is usually scaled by an inverse factor of 0.015 to provide more readable numbers:

The CCI is a very standard indicator that gives easy to use, buy and sell, signals; also, it helps to identify overbought and oversold areas of price deed. The CCI is calculated so that roughly 75% of price movement should be between +100 (overbought) and -100 (oversold).

Have a great weekend everyone!

|

|

|

| Posted by at 12:49:07 PM |

| -------------------------------------------------------------------------------------------------------------- |

|

| Leave a Reply |

21 Visit(s) |

|

|

|

|

| |

0 Comment(s) |

|

|

Blog Home |

|

|

|

|

|

|

|

|

|

|