|

Copper is considered a barometer for world economic

activity. The rise in copper prices hints that the economic activity in the

world is increasing while the fall in prices hints that the activity is

decreasing. While we are not here to discuss this simple theory, we are however

here to discuss on the recent movement of copper prices. We are here to try to

demystify the volatility in copper prices.

- So what has happened in the world that

created the volatility that we see in copper?

- Wasn’t the world recovering from the

economic turmoil and wasn’t this suppose to push copper prices to new highs??

- What went wrong??

If any of these questions make you lose your sleep, then, my

dear readers, please read on.

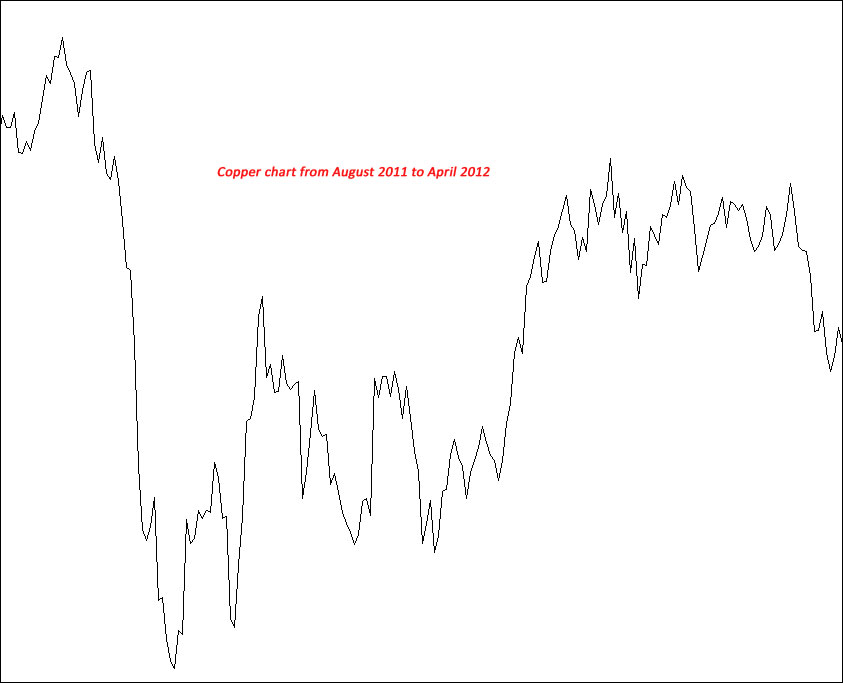

As can be seen from the chart above, copper seems like it

dropped off a cliff during late august, last year. How could this have been

possible when the whole world was recovering? One needs to think China at this

moment. In recent years, China has emerged as a major player in world economy

and has even managed to become the second biggest economy in the world. China

again, is one of the largest importer of copper. Due to this reason, what

happens in China doesn’t stay in China anymore, it affects the world commodity

prices.

Inflation fears, coupled with a slowdown in the Chinese

economy pressured copper prices last August. Five interest rate increases,

limits on home purchases and lending curbs were some of the measures that the

government of China took in order control inflation. However, all these

measures were not enough to reduce inflation which was at that time, hovering

around 6.5 percent, a 3 year high. The measures were however slowing the

Chinese economy which for many traders meant, that the economic activity and

hence, copper imports would fall in the coming months. As a result, copper

prices made a free fall which lasted till the first week of October. However,

copper prices then did a u-turn and started increasing. The prospect of the

Greek debt ordeal FINALLY coming to an end as well as positive economic data

from the US saw many copper traders return to the market with smiling faces.

But all that seems well is not well, so it seems !

With the world media and the American media in general

talking about how the recession has ended and how the world is actually

recovering, one might seem to think that is the case. However, the prices in

copper depict otherwise. After a slight rally that lasted just 5 months, we can

see that copper prices started a slow and painful rally to the south.

So what has transpired this downward trend in copper

prices??

Think again China! Think again World recovery. These two

terms have come back to yet again haunt copper prices as it has been revealed

that there is now more copper in China than any other time in history and the

economic growth that was at an envious double digits is sharply slowing. At the

same time, the recovery that was supposedly underway in the world seems to have

hit a snag and all is not well on both sides of the Atlantic. The disappointing

economic data coming out of the US as well as Europe all suggest that the

recovery that was so well and truly underway might have stalled.

So one is left to ponder as to what could be the step in the

right direction? Dear readers, please proceed with caution. There are bumps

along the way and the best way forward is through careful study and appropriate

trading discipline.

Have a great weekend! :)

|