|

|

|

| Page Hits : 11154 |

|

|

Mercantile Exchange Blog |

|

|

| |

Jan 19 2012 |

| The Saga of Gold: Awaiting the Rise |

Note: The following is the author's opinion and cannot be deemed responsible for any losses incurred.

Investors are well-acquainted with the fact that gold prices have hit a new high with each successive year since time immemorial and that could set to continue this year too. But the current trend of gold are giving investors sleepless nights while it seems stuck in a rut. This stall in the prices has happened before, of course, but since 2001 it has always eventually powered to a new high. Unless one believes that the gold's bull market is over, it's natural to wonder how long the investors might wait before witnessing the rise again.

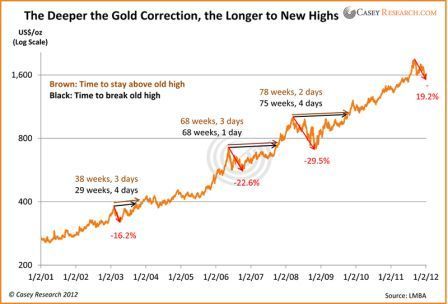

The events on both sides of the Atlantic are giving the investors a wait-and-watch strategy as investors hesitate to take appropriate decisions given the unpredictability of the situations. Others (like yours truly) are examining the size and length of past corrections and how long the gold prices took to reach a new highs afterwards. Gold had set a new record in September 2011 and then nosedived into unchartered territory. In order to determine how long it might take to breach the record, yours truly conducted a research on the past corrections.

As you can see from the above illustrations, it took a significant period of time for gold to forge new highs after big selloffs. And yes, the bigger the corrections, the longer it took. In 2006, after a total fall of 22.6%, it took a year and four months for gold to surpass its old high. Likewise, after the 2008 meltdown, it was a year and six months later before gold hit a new high. Our recent correction closely resembles the one in 2003. After a 16.2% drop, gold matched the old high seven months later. It took another two months to stay above it.

So the question arises-When will Gold hit an all-time high again? I cannot tell you exactly when the gold prices will start shooting off the charts. Regardless of the date, I am confident that a new high in the gold prices is certainly on the cards because major currencies are unsound and overburdened with debt-and they're all subject to government tinkering amongst others. The ultimate high could be frighteningly higher than current levels. Taking advantage of the opportunity could be the way forward for the investors. So the question now is-When? |

|

|

| Posted by at 12:37:12 PM |

| -------------------------------------------------------------------------------------------------------------- |

|

| Leave a Reply |

33 Visit(s) |

|

|

|

|

| |

0 Comment(s) |

|

|

Blog Home |

|

|

|

|

|

|

|

|

|

|