Yesterday, we had discussed about the basic differences between the WTI and the Brent Crude. Today we would like to explain the price differences between the two categories of oil.

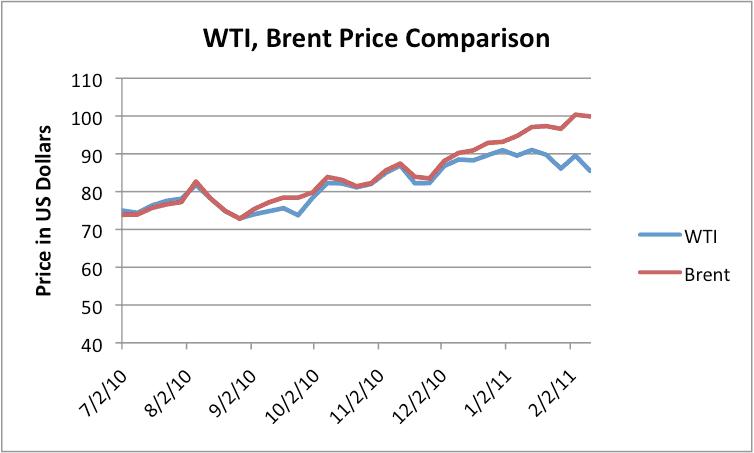

There existed a typical price difference per barrel of between +/- 3 USD/barrel prior to September 2010 in the prices of WTI and Brent Crude. However since the autumn of 2010 there has been a divergence in the prices reaching over $11 a barrel by the end of February 2011. Many reasons have been attributed for this widening divergence ranging from a speculative change away from WTI trading, dollar currency movement, regional demand variations, and even politics. In February 2011, the divergence reached $16 during a supply shortage at the North Sea and simultaneous record stockpile at Cushing, Oklahoma. Historically, the different price spreads are based on physical variations in supply and demand (short term).

The recent MENA crisis had provided impetus to the prices of both WTI and Brent Crude. The prices of Brent crude had reached a record price of $126.74 on the 9th April whereas WTI had reached $114.82. This large spread between the categories is likely to continue until unrest across the MENA region subsides or fleets of trucks start supplying oil from the US. If crude oil is subject to a shortage in one region and there is an excess supply in another, oil will eventually be redirected, depending on the shipping industry’s capacity to move it around. This redistribution can take a few weeks or months, but over the medium term the market naturally rebalances.

An illustration of the widening divergence between WTI and Brent Crude has been provided below.

As we can observe from the above chart the divergence between WTI and Brent Crude began in December of 2010 and has been widening ever since. So how can an investor benefit from this ever widening spread?

There is no guarantee that Brent will outperform WTI but there is no surety that it won’t either. The excess supply of the WTI crude coupled with the shortage of supply in the Brent Crude might see a further divergence in the days to come. But all it takes is a drop in the US inventories to quickly provide impetus to the prices of WTI crude. One option for an investor is buy one and sell the other, depending on which way the spread is going to go. The ever-increasing Brent crude prices might seem to be a worthy long position at the present and a consequent short position in WTI. But any relevant data can change your fortunes also.

There is a current spread of $12.32 in the prices of Brent and WTI. Will the spread increase or will WTI bounce back to command higher prices. Only time will tell. |