|

|

|

| Page Hits : 11152 |

|

|

Mercantile Exchange Blog |

|

|

| |

May 25 2012 |

| Oil on Slippery Slopes |

We may eventually run out of oil in the near future, but the way prices have been falling, “black gold” will probably not hit the $150 like in 2008. Some analysts believe that oil prices were a contributing factor in bringing about the recession, but others argue that the high price simply reflected growth in demand that far outpaced supply. Whatever the case, given the slowing world economy and the on-going crisis in the Euro Zone, demand has been suppressed. Although prices are falling, it is still difficult to know if prices will now meet resistance soon or will keep declining.

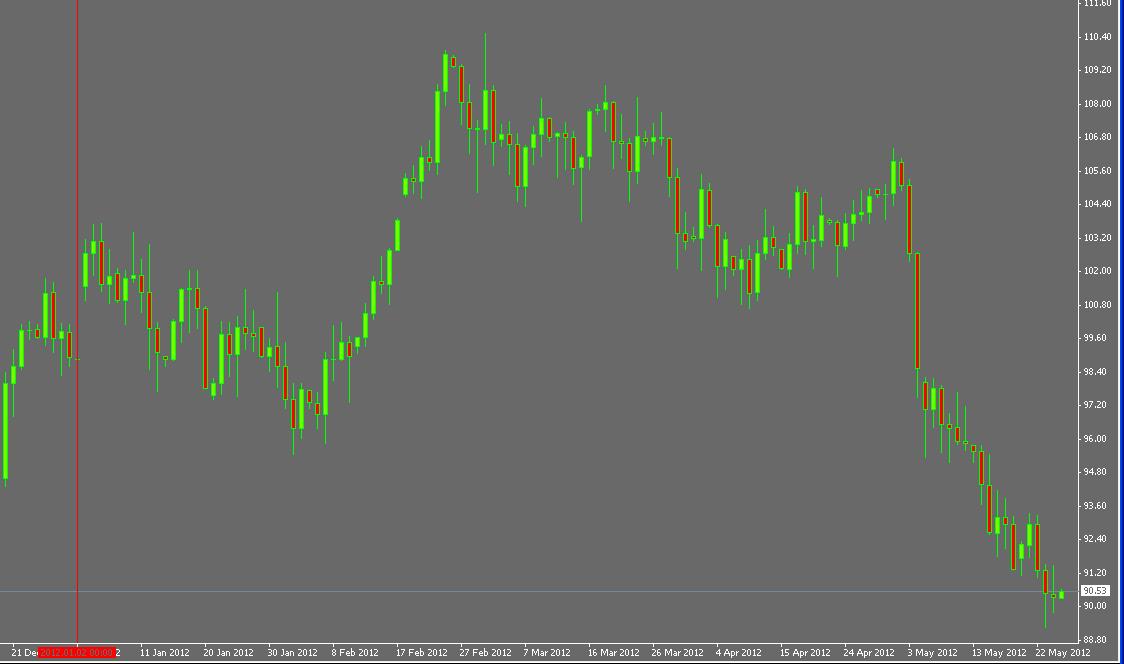

On May 23rd Crude Oil fell to a 7 month low amidst bad news from both developed and emerging markets. Oil has fallen below $90 following a series of steep declines since the beginning of May where Oil was traded at a high price of around $104. The New Year began with Crude oil being traded around the $100 mark and moved up during February after data began to show a positive outlook on the U.S economy. By March it had become apparent that the Euro Zone crisis is deeper than expected and the US economy has not been recovering as expected. The recent fall in prices this month owes to a worsening situation in the Euro Zone, but other factors such as possible successful talks with Iran has also contributed. The strengthening Dollar against major currencies has also been a factor.

On the supply side, the Department of Energy’s weekly report shows that supply has increased by 883,000 barrels to reach 382.5 million barrels. Relaxation of sanction on Iran will also add more oil into the market and might further depress prices. As of now, investors in Oil futures will need to closely watch the crisis in the Euro Zone. A Greek exit is most likely to depreciate the Euro further. In addition, the talks with Iran in Baghdad should also be closely monitored.

|

|

|

| Posted by at 12:27:58 PM |

| -------------------------------------------------------------------------------------------------------------- |

|

| Leave a Reply |

32 Visit(s) |

|

|

|

|

| |

0 Comment(s) |

|

|

Blog Home |

|

|

|

|

|

|

|

|

|

|