|

|

|

| Page Hits : 11152 |

|

|

Mercantile Exchange Blog |

|

|

| |

Jul 29 2013 |

| Monetary Policy: Hopes Aplenty! |

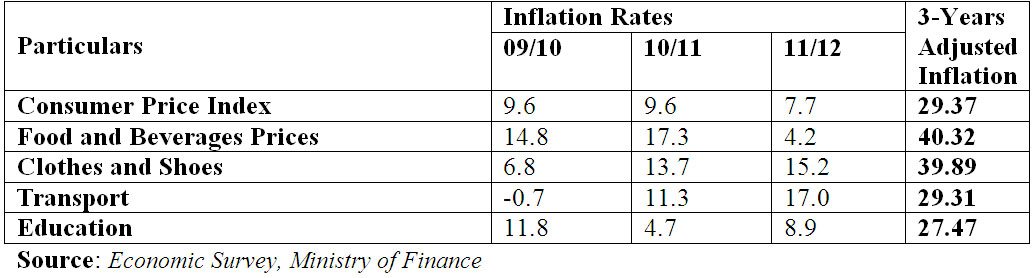

For the economic development of any country, the policies – monetary and fiscal - give the foundation and complement one another for the attainment of the common growth and welfare objectives. By now, we have already received the monetary policy for this Fiscal Year which is supposed to complement the fiscal policy of the country to achieve the targeted growth of 5.5 percent and control the inflation to 8 percent. Figures speak more than words:

It feels really good when the country has witnessed its full budget and it will definitely be encouraging for the whole financial fraternity and this time hopefully monetary policy will fully comply and back the fiscal policy. But the question still remains- How? Our monetary authority is confident enough to pronounce its monetary policy as flexible-where our government has been so flexible for various market malfunctions like not penalizing the water and milk contamination, not penalizing those who have cheated in the gold business, etc.

The salaries of the civil servants has been increased by 18% on an average and the expected money supply increment in the market is 16%, besides that the Cash Reserve Ratio of banks have been brought down, CRR for commercial banks is now 5%; and with this governance, it would not be amazing if we see market prices of necessary commodities rising by more than 20%. Our Foreign Currency Reserve has increased by 16.4 % overall, deposits in the banks and financial institutions have increased by almost 16% but the investment portfolio of the financial institutions is still narrow.

It is very encouraging to find that credit expanded by 36% in agro-sector of the country, which is yet the backbone of the economy and the policy has emphasized on efficient Deprived Sector Lending by financial institutions supported by the influencing rate of refinancing in the agro, hydro, fishery and productive loans. The spread rate is supposed to be at five percent which may bring the loan rates in the affordability and accessibility range of most of the population. Financial Literacy is of utmost importance in the Nepali financial market and the policy gives sufficient room for the improvement of the same.

As in previous years, the policy looks good, undoubtedly, and has enough spaces to complement fiscal policies but what we are concerned with is the same old problem- Implementation! Contradicting few points in the policy does not make anyone anti-national rather the intervention points can be discussed further. Monetary policy is still awaited to address the identification of “warehouse receipt” as collateral in accordance to Secured Transaction Act 2063. With these policies, development can be assured but political stability and governance is the NEED!

|

|

|

| Posted by at 2:29:04 PM |

| -------------------------------------------------------------------------------------------------------------- |

|

| Leave a Reply |

34 Visit(s) |

|

|

|

|

| |

0 Comment(s) |

|

|

Blog Home |

|

|

|

|

|

|

|

|

|

|