|

|

|

| Page Hits : 11152 |

|

|

Mercantile Exchange Blog |

|

|

| |

Jan 29 2013 |

| Gold: Journeying towards higher ground! |

Gold, being a safe haven, has always been an investor’s delight in hedging against the market risks in the global financial spectrum. Given, the credibility of the sources, yours truly will try to derive the crux of the matter in gauging the futuristic journey of gold for my ardent readers. Lets dissect the following points carefully:

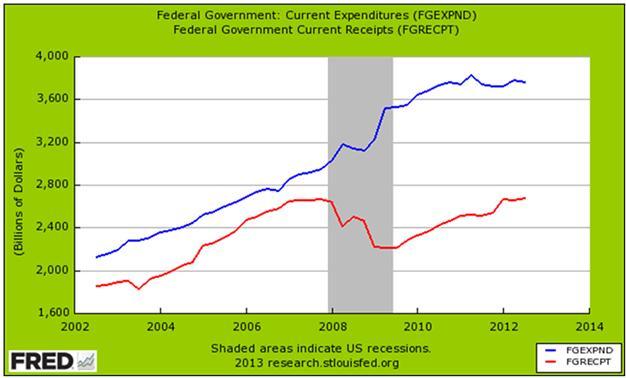

1. US Federal Government deficits

Courtesy: Federal Reserve Bank of St. Louis

The above chart shows the increasing gap of the US Governments deficit since 2008. The professed gap shows no signs of narrowing, given the requirement of increased taxation which subsequently suppresses the economic activities of the economy or decreased spending. Deficits are part and parcel of the global economy, be it the US or any other nation. It is observed as a major driver in rekindling the prices of gold upwards.

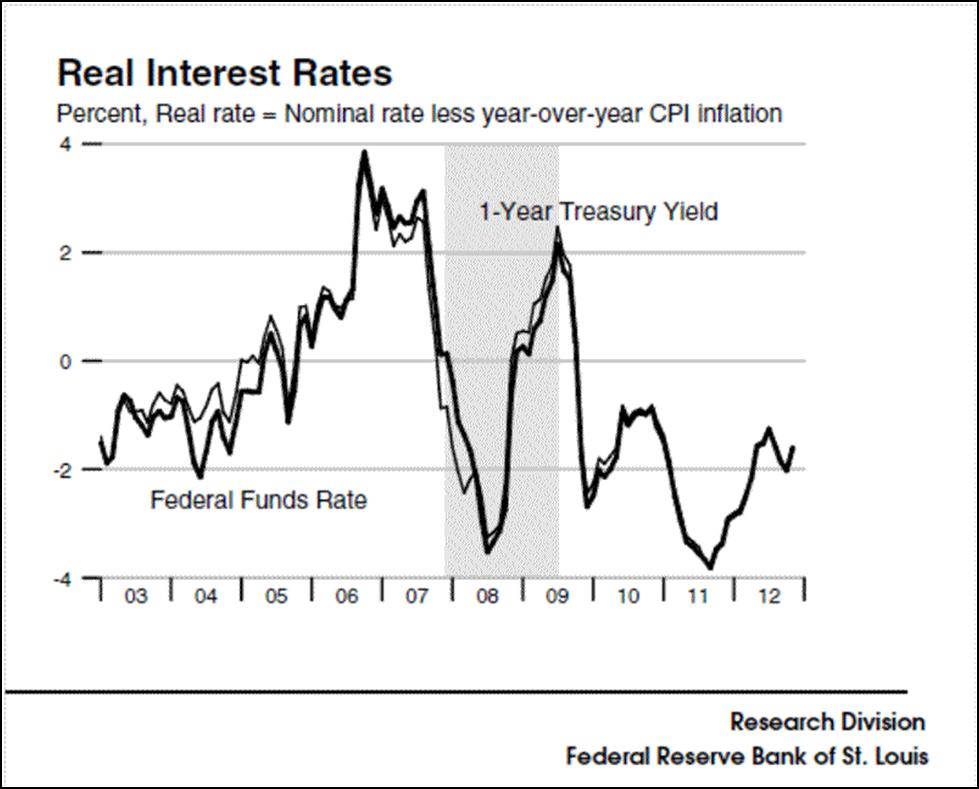

2. Real Interest Rates

Courtesy: Federal Reserve Bank of St. Louis

The illustration above shows the real rate if interest which is derived by deducting the price inflation (CPI), from the current Treasury Yield. The current real rate stands at -1.75%. Confused? Let me explain. The figure suggests that the money held in Treasuries is losing out by more than 1.75% per year. In view of the conceived fact that the official CPI rate is a bogus measure furnished by the authority to conceal the actual rate, the real rate of inflation is perceived much worse than the chart portrays. This provides a major impetus to the prices of gold to rise.

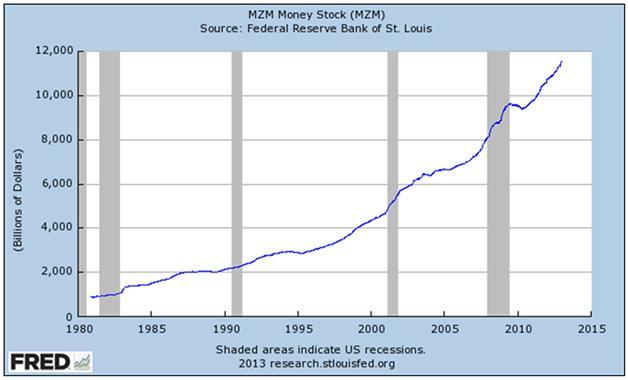

3. Currency Destruction

Courtesy: Federal Reserve Bank of St. Louis

The above illustration shows the money inventory continues to rise despite its negative effect on the economy. In the past four years the Obama administration, in collaboration with the U.S. Congress, has added five trillion dollars to the U.S. Federal debt. At the same time five Central Banks printed seven trillion dollars in new currency. Thus twelve trillion dollars that did not exist in 2008 are now looking for a residence. This monetary destruction produces price inflation (after a gap as it takes the average person a while to catch on). “Like gold, US dollars have value only to the extent that they are strictly limited in supply. But the US government has a technology called the printing press that allows us to print as many dollars as the government wishes, at essentially no cost” the words of the man himself, Ben Bernanke.

Since the modern gold bull market began in 2002, there have been three major corrections along the way till date. The first one began in 2006. It took a stupendous 71 weeks before a new record high price was established. Gold then rose by a mild 50% thereafter! The next correction began in 2008 and it took a further 77 weeks before gold established a new record high. Prices then rose by a staggering 90% thereafter. The current correction, which began in 2011, has taken 72 weeks since the last time gold was at a record high price. As long as the major drivers are firmly pressing the accelerator, the journey for gold seems to be ready for a major drive northwards in the forthcoming days. The question is-when the race is going to begin?

Note: This blog is just an expression of the author’s opinion and cannot be deemed responsible for any losses incurred.

|

|

|

| Posted by at 11:09:56 AM |

| -------------------------------------------------------------------------------------------------------------- |

|

| Leave a Reply |

18 Visit(s) |

|

|

|

|

| |

0 Comment(s) |

|

|

Blog Home |

|

|

|

|

|

|

|

|

|

|