|

|

|

| Page Hits : 11152 |

|

|

Mercantile Exchange Blog |

|

|

| |

Jun 22 2012 |

| Commodity Market: A Round Up |

Thursday 22nd saw the biggest fall in commodity prices this year. A widely watched commodity index, the Thomson Reuters-Jefferies CRB index, lost more than 2%, bringing the index down to the same level as September 2010. The decline comes a day after the Federal Reserve downgraded forecasts and bad manufacturing data came from China. The weakness in commodity prices is seen as reflecting a bad global economic climate. Analysts claim that market fundamentals have been bad for some time now, but investor sentiments of a recovery had been positive. The FOMC statement on July 20th as well as no end in sight to the Euro crisis has put an end to positive sentiments.

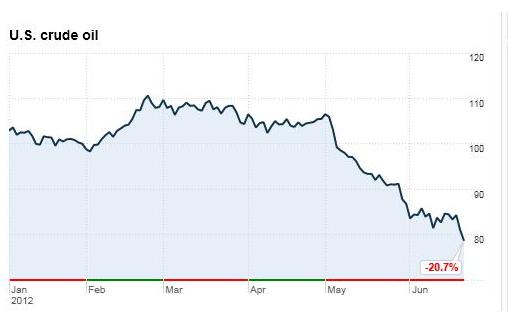

Oil prices have finally dipped below the $80 mark on Thursday. Analysts claim that because psychological barrier, which had provided resistance at the $80 dollar mark has been crossed, there is nothing stopping oil from declining further based on market fundamentals. Compared to the start of 2012 Oil has declined by 20%.

Gold prices have also taken a hit recently with the rising US dollar and anti-inflationary pressures in United States. Traditionally, Gold has been used as a bet against inflation. With the declining commodity prices, inflation in the U.S has been pushed to near zero. Similarly, investors have shifted investments from Gold to U.S dollar which has been appreciating against major currencies since the March 2012.

Until there are some improvements in market fundamentals, it is likely that commodity prices will slip further. However, agro-commodities are doing relatively well and are unlikely to be affected as much. Investors should watch out for any news that is likely to affect investor sentiments. Fundamentals take a long time to change, but markets are drastically affected by the psychology of investors in the short run.

|

|

|

| Posted by at 3:39:50 PM |

| -------------------------------------------------------------------------------------------------------------- |

|

| Leave a Reply |

34 Visit(s) |

|

|

|

|

| |

0 Comment(s) |

|

|

Blog Home |

|

|

|

|

|

|

|

|

|

|