|

|

|

| Page Hits : 11152 |

|

|

Mercantile Exchange Blog |

|

|

| |

Jun 13 2012 |

| 2012: Year of the Bear |

Compared to the dooms day prediction that the world will end sometime this year, omens predicting a global recession doesn’t sound too bad. However, no one really knows what a modern global recession is really like. The Great Depression of the 1930’s is probably the closest thing we can compare to a global recession. Although the Great Depression affected the United States and European nations the most, many countries in Africa, South America and Asia were not spared from the consequences of reduced trade. Fast forward to 2012, and the world has become even more interdependent and the consequences of any crisis are far reaching and often interact with each other.

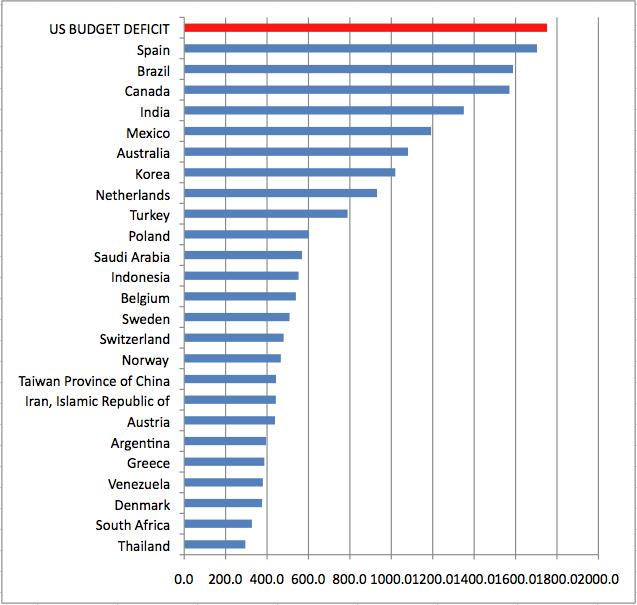

A report released by the World Bank on Tuesday hints at a global slowdown in the world economy for the coming few years. Not only does it predict growth to fall in developed countries, but emerging economies are also likely to face rates of growth that are the lowest in decades. The Euro crisis has demonstrated one fundamental fact; countries need to be cautious about government debt. The problems afflicting Spain and Greece are not just about low economic growth, but a government deficit that is unsustainable. India is facing a similar problem, with a ballooning government deficit at a time when indicators show both a slowdown of growth and an industrial sector that has shown almost zero growth. The latest Chinese manufacturing indices have shown similar results with a slight contraction in manufacturing.

Around 40% of developing countries were running a trade surplus prior to 2007, but in 2011 only 19% showed surplus. Capital flows from developed countries to developing countries have also fallen by around 40%. The consequences of all these numbers and facts should have tremendous impact on industrial commodities and precious metals. However, there is a likely-hood that the Euro Crisis might turn things around. As of now, traders would find it beneficial to follow the Euro Zone crisis closely, but industrial news from emerging markets might actually be a better indicator of where commodity prices are going. |

|

|

| Posted by at 3:17:26 PM |

| -------------------------------------------------------------------------------------------------------------- |

|

| Leave a Reply |

29 Visit(s) |

|

|

|

|

| |

0 Comment(s) |

|

|

Blog Home |

|

|

|

|

|

|

|

|

|

|